With Spring now firmly underway and many countries moving away from pandemic restrictions, the team at Global Asset Solutions is seeing increased demand for experienced asset managers across the hotel industry.

With hotels stripped back to the most basic of operations and the return to travel still patchy, in-depth knowledge is required to help handle rising costs and find those opportunities to drive revenue.

The Continued Evolution of Hotel Investment – webinar

Alex Sogno, CEO, Global Asset Solutions, will be taking part in the latest webinar hosted by Watson Farley & Williams – The Continued Evolution of Hotel Investment – on 6 April. The series has explored the continued evolution of hotel investment and the latest episode will focus on how the market is changing and why the asset is the key.

Click here to sign up to this free to attend session.

Lenders turn to asset managers

Fred Novella, managing director, Global Asset Solutions, talked to Hotelier Middle East about the growth in lenders insisting that asset managers are bought into hotels that are both under stress and running relatively normally.

Fred said: “There have never been more participants in the hotel stack than now. The owner/operator model is now the exception, not the norm, and the pandemic has meant that even more participants may have joined the stack as emergency funding was sought. The asset manager can help ensure that all parties work together and all parties have their interests served.

“The hotel sector – and the wider world – is in the middle of a costs crisis, with energy and staffing accounting for more cash than ever before. Asset managers can help manage all these factors and help the property move towards profitability. They can advise on where hard-found capex should best be deployed to compete effectively and draw guests.

“The hotel sector is coming out of the pandemic looking very different to how it went in. Amidst the pain, there have been great learnings that will be carried into the future. But only by working with experienced asset managers can you spot every critical nuance.”

Read the full story by clicking here:

From revpar to revenue per square foot

Dimitris Mittas, vice president, Finance, Europe, Global Asset Solutions, Ibiza, investigated ways to increase revenue per square foot as the sector moves away from measuring heads in beds and towards focusing on every square inch.

Writing in HOTELS, Dimitiris said: “When you asset manage a property you are doing exactly that – managing a whole asset. Not just the beds, not just the restaurant, not merely the spa, it’s the whole asset. That includes the space on the pillow where your head goes, to back of house where no guest goes.

“Hotels have become more creative during the pandemic. Having your balance sheet stripped back to nothing has pointed out many areas where money was being wasted, which may have gone unchecked when trading was good. But while hotels have identified areas where costs can be saved, it can be harder to find areas where revenues can be generated, particularly while the focus remains on the leisure guest.

“The sector is wise to upselling at check-in – in the main – but here are five ideas which you may not have considered.

- Allow more space for staff. The back of house areas can be cramped and uninspiring and a huge contrast to the experience of the guest, particularly in the luxury sector. We want people to feel valued and giving them more and better space in which to work tells them that they are a team, not servants in a 19th century manor house. A motivated team delivers that exceptional experience which drives true lifetime loyalty.

- Install cell phone antennas or cameras on the roof top. Very few hotel rooftops are used, but installing cell phone antennas or, if you are next to an airport, cameras to provide information, means additional revenue, which goes directly to the owner.

- Include community shops and artists in unused spaces. Many hotels have unused space on the ground floor, and this can be rented out – either long term or for special events. This generates income, but also adds interest for the guest. Properly curated, it helps to create a sense of place and a feeling of community, which is growing in demand from guests looking for unique and authentic stays.

- Increase the private space in your spa. It may seem counter intuitive, you may think that more is more when it comes to the spa, but the pandemic has seen guests value having their own space instead of sharing with others. Guests are now eager to have the sauna and the hammam to themselves and will pay more for the convenience and added relaxation of being the only group as they unwind.

- Don’t forget the façade. Hotel operations can be very focused on what happens inside the property and forget that there is a world out there, looking on. Using the façade can drive interest in the hotel and help to set the tone for passersby, as well as raising revenue.”

Read the full story here.

__________________________________________________________________

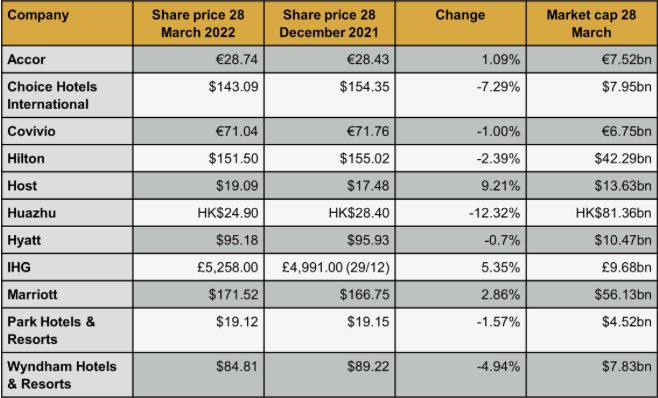

The sector in numbers

The movement of the share prices in the sector has mirrored the evolution of the pandemic. The fall from Huazhu clearly illustrates the impact of having a zero-Covid policy such as China’s, while elsewhere in the market, Wyndham and Choice are down, but only after gaining strong support because of their economy brands.

When travel made its cautious restart, the lion’s share went to brands which could offer a cheaper night’s stay, but with more familiar travel trends returning, demand is evening out. A recent study from HotStats found that luxury hotels have bounced back faster than any other segment, but key to this is keeping a close eye on operations. At Global Asset Solutions we have kept a rigorous watch on every aspect of our hotels, ready to build future growth on strong foundations.

Case Study: Rosewood Phnom Penh, Cambodia

Since its opening, the Rosewood Phnom Penh offers an “ultra- luxury” hospitality experience in the Cambodian capital. Located in Vattanac Capital Tower, the Rosewood Phom Penh is the tallest building in the Capital, which provides breath-taking 360o views of the city, bringing a new level of luxury to the city.

We have managed the hotel under Douglas Louden, senior asset manager, Global Asset Solutions, since 2018 and earlier this year we were thrilled to report that the Sora Sky Bar at Rosewood Phnom Penh was named as one of the city’s best rooftop bars in this article by Air Asia.

Read more about our work with the owners of the Rosewood Phnom Penh here.