This is the third article of a series that focuses on the owner’s perspective on key issues in the industry. In the first, we presented the fundamentals of asset management. In the second, we suggested practical aspects to owners on the matter of the mergers and acquisitions wave amongst operators. In this third, in collaboration with Cindy Estis Green, we tackle the burning issue of the management of the profitability of distribution.

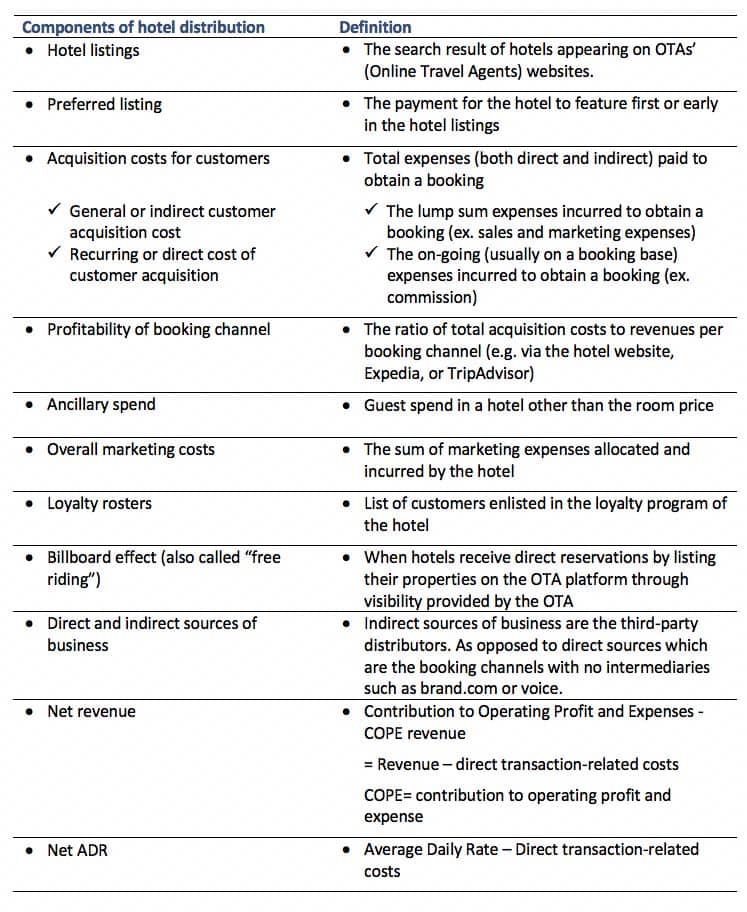

2016 marked a new step in hotel distribution with active participation in travel of Google, TripAdvisor and others entering the market with instant book and other transactional models. In this third article, we provide a straightforward assessment and actionable guidelines for owners with regards to the management of their room inventory. We trust that it will shed light on the current situation and inform about future possible actions. To facilitate the navigation in this intricate environment, we also present a nomenclature of the developing jargon in hotel distribution.

The profitability components of distribution

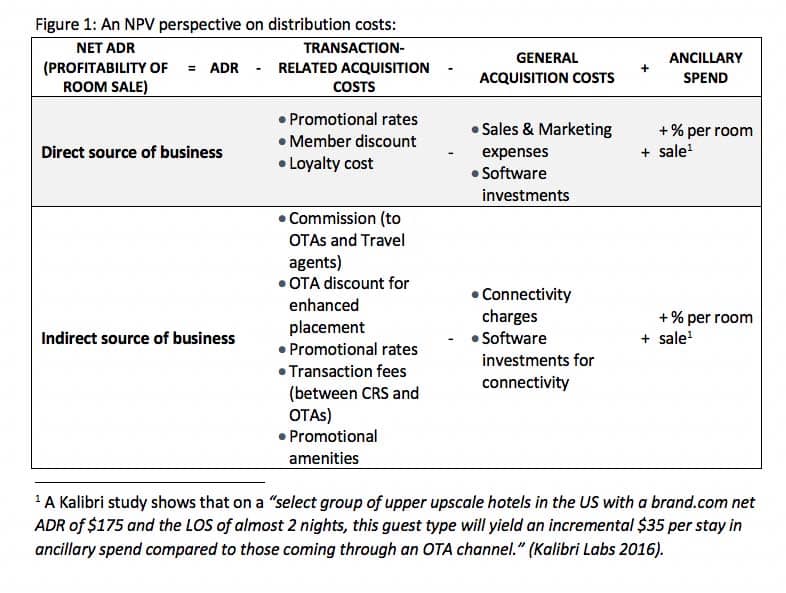

Through the Net Present Value (NPV) lenses, the profitability pattern of a direct booking differs from an indirect booking in three aspects (Figure 1). 1. The cost of acquisition (or the initial investment in getting the guest to book). 2. the net revenues from each sale (or net cash flow). And 3. the number of repeat visits of guests (i.e. the time element in the NPV formula).

Asset Managers have to be well versed in the subject to be able to identify potential hidden costs. After all, as owners expect operators to generate direct bookings, management fees are computed on the basis of the “full ADR” and not on the “net ADR”.

As a result, opting for a direct or indirect way to sell the room is the strategic decision of outsourcing. It is, therefore, a question of horizon and perspective. On the one hand, there is the decision of selling and distributing the rooms using in-house capabilities. This is the direct booking option, which supports a more long-term perspective. It assumes that resources and capabilities, such as staffing, marketing, and distribution know-how are available and will be further developed in house. Also, it supposes the potential repeat visits of guests. In which case, the initial direct costs are lower in direct booking as the sales and marketing expenses incurred are spread over future visits. On the other hand, there is the decision to buy the services (i.e. outsource). This is the indirect booking option, which is more immediate and generates “instant” direct benefits. It presumes that ensuring a sold room in the short term prevails despite the intermediary costs incurred and despite a potentially lower guest-paid revenue.

But all in all, this decision is based on the effectiveness of the services of the intermediary and the alignment of its values with the property owner’s. There is a risk of dependence on third parties whose incentives are not always aligned with the those of the owner. If there is a recession or downturn, and the hotel does not have a diversified enough channel mix, then the hotel would be subject to any conditions the third party applies. Hoteliers experienced this in the 2008 recession when commission rates reached up to 35-40%.

The 4 fundamentals of distribution from an owner perspective

The decision to opt for direct or indirect booking is a matter of working to achieve a hotel’s optimal business mix. The goal today is to manage the distribution channels (Blal and Cheng, 2015) and it boils down to four fundamentals:

-

- Control over the process. Or the degree of control the hotelier can enjoy or would like to have over the establishment of the daily rate, promotional activities, and image of the hotel. But this control comes at a cost (i.e. staffing, managing the distribution contracts, etc.…). Part of these expenses can be aggregated at the corporate level for large operators.

- The cost per transaction. Or how much is spent to acquire a booking through a third-party distributor. This includes the commission but also other transaction fees (Figure 1) such as promotional amenities through loyalty programs (e.g. American Express Fine Hotels & Resorts).

- The proportion of repeat customers in the hotel. Or the frequency of transactions, and the long-term relationship with the customer, are at the heart of the decision. While some hotels enjoy a stable base of repeat customers or present the potential to do so, others work with transients and therefore would gain less from managing the distribution internally.

- The total revenues. At the end, it is about the total expenses over time from one customer. Simply put, the fourth fundamental is the total revenues generated by a hotel guest over his/her entire relationship with the hotel and not just the ADR collected during each stay.

Aside from this clarification of the aspects to ponder and monitor, we also recommend the following actions in order to enhance the profitability of the distribution process.

5 actions for owners to enhance the NPV of distribution

- Monitoring direct vs. indirect booking.

It is essential to find a way to have a clear overview of how business is booked directly as compared to indirectly within the hotel. This tracking requires an initial effort to establish new recording processes, but can provide useful insights into the return of distribution. For asset managers, it is a useful tool to monitor the marketing and sales efforts of an operator to generate the expected direct bookings. - Adapting the choice of channel to the market type.

It is important to understand how much of each type of business is available in a hotel’s market as the value of intermediary services varies accordingly. For instance, some markets do not generate repeat business by nature, therefore, indirect booking, in this case and for certain types of business in that market, is more attractive. - Dynamic booking.

We believe that a more dynamic booking system can benefit owners. This refers to adapting the room rate to the changes in volume of sales and repeat customers. In other words, it entails departing from a fixed commission rate and negotiating with third-parties the payment of their services based on the volume of room sales they generate. The monitoring of sources of business is useful to apply this third action. - Focus on ancillary.

The ancillary spend can be a major driver of profitability of a booking channel. It appears that guest tracked via direct booking can spend more in ancillary services. Moreover, the inclusion of these services in a package for the direct channels can help differentiate this outlet as opposed to the intermediary’s in a market with repeat customers. It would, therefore, be interesting to develop an ancillary offer which could complement the room product to increase the total customer value proposition of the property and thus the daily rate. - Approach OTAs as complementary.

Hoteliers can utilize their presence on OTAs as one of many search engines for travel products but as for booking, a diverse and healthy mix of direct and indirect bookings is generally the objective. This specific mix will vary quite a bit from hotel to hotel, and market to market. When OTAS are one of the tools guests use to look for products, compare, and read reviews, they can complement the hotel business. As such, new marketing strategies need to focus on accepting that guests consume the services together and trust the booking step with the hotel.

Nomenclature: Clarifying the developing jargon of distribution

References

Blal, I. & Chen, C-M. (2015). The age of distribution channel marketing. HospitalityNet, 19 November 2015.

Estis Green, C. (2016). Booking direct: the numbers tell the story. Hospitality Upgrade. www.hospitalityupgrade.com Summer 2016.

Authors

|

Alex SognoAlex Sogno is a Founding Member of the Hospitality Asset Managers Association Asia Pacific (HAMA AP) and Middle East Africa (HAMA MEA), and the CEO of Global Asset Solutions, which provides expert oversight and asset management in the hospitality industry throughout Europe, Middle East, Asia and Pacific. He has lectured frequently and published several articles on hotel real estate finance and asset management. Mr. Sogno is also the co-writer of the ‘Hotel Asset Management’ textbook published by the Hospitality Asset Managers Association (HAMA), the American Hotel & Lodging Education Institute, and the University of Denver. |

|

Inès BlalInès Blal (Ph.D., Virginia Polytechnic Institute and State University) is an Assistant- Professor of Strategic Management at the Ecole Hotelière de Lausanne, Switzerland. Her current research involves performance measures of lodging corporations and the impact of the asset-light model. Inès regularly presents her research at academic and professional conferences. She also provides executive education and is the author of case studies in strategic management for the hospitality industry. |

|

Cindy Estis GreenCindy Estis Green is CEO and co-founder of Kalibri Labs, a company that offers an analytics platform that enable hotels to plan and monitor profit contribution by channel and segments. A 35-year veteran, she is co-author of the industry bestseller, “ Distribution Channel Analysis: A Guide for Hotels,” published by the HSMAI Foundation and AH&LA. |

Post

Portugal Hotel Market Outlook 2024

PORTUGAL’S HOSPITALITY INDUSTRY is experiencing an impressive comeback post…

Post

Know thyself for budget success

“Before you can budget for the year ahead, it is critical that you assess the…

Post

Should hotels refuse to join a club which would have them?

The current battleground for the big hotel chains is not pipelines, but loyalty…

Post

The digital concierge: how can hotels use technology to maximise revenue and customer experience?

More than half of all business trips are now a mix business and leisure – so…

Post

Spanish Hotel Market 2024

SPAIN’S TOURISM SECTOR in 2023 exceeded all initial expectations and surpassed…

Post

Balancing the scale of luxury

Tell someone in the sector your hot new tip is luxury growth and you’ll lose…

Post

The luxury sustainability conundrum

Climate change is one of the most significant challenges society is facing, but…

Post

Failing the AI tech race

Attend any conference over the past decade, and a common theme is the devilish…

Post

From compound stays to compound interest

Back in the days of yore - or, for those who measure time this way -…

Post

Projecting into an AI future

The world of hospitality has seen remarkable changes over the past few decades,…

Post

Bringing strength to soft brands

‘Another day, another brand’ could well be the catchphrase of our sector, but…

Post

The need for CAPEX and creating returns

As an asset manager, it’s my job to create and manage the relationship between…

Post

Budgeting for change pt.2

In the second of our series on the budget approval process, we are looking at…

Post

Budgeting for change pt.1

Each season brings with it change and, depending on the time of year, the…