Global Asset Solutions and Origin World Labs present a study for hoteliers, revenue managers and owners with key market trends by region for Summer 2020.

As hotels begin to re-open, revenue managers need to decide their pricing and rate strategy. As there is no historical data to refer to, revenue managers will need to pay attention to their entire market and look beyond their comp set. Technological tools such as the RADAR report provide you with the forecasted rates for each market and can be tailored to each hotel’s unique circumstance and competitive set. This study will focus on the room pricing outlook for two main European markets: London and Paris.

How Hotels are Adjusting their Rates

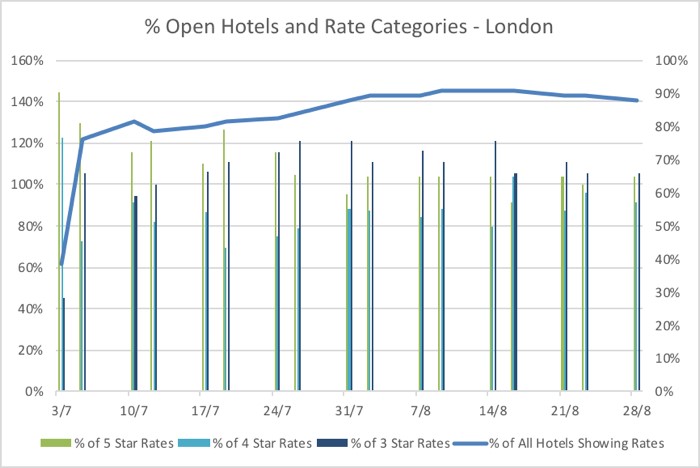

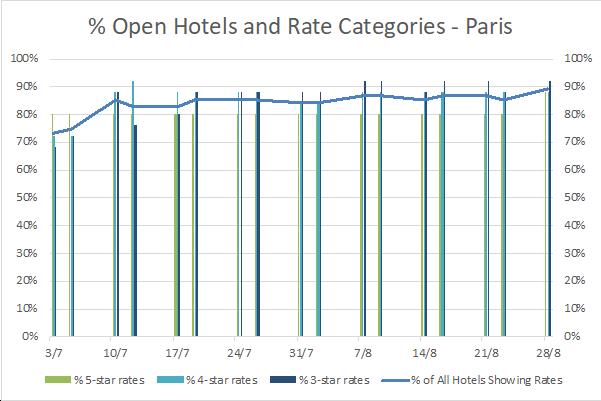

Throughout May, many hotels were anticipating re-opening by July. At this point, about 90% of hotels are expected to be open in each city throughout July and August. Despite being open, hotels are pricing themselves into different rate categories than would be expected, given the current circumstance. Many of the 4-star hotels in London are pricing themselves in the 5 and 3-star categories. Meanwhile, in Paris, the trend shows more 3-star hotels are pricing up to 4-star rates rather than the opposite.

In London, it is expected that between 100%- 120% of the hotels disclosing rates will be using 3-star rates through the end of August. This means that though 4-stars hotels will be open, they will be offering a significant decrease in rates given the current situation. As can be seen in the graph above, at the beginning of July over 100% of hotels are pricing in the 5-star range, meaning that 5-star hotels are not pricing down and 32% of 4-star hotels disclosing rates, are pricing up. Prices begin to converge in August as each rate segment begins to share an equal portion and rates begin to normalize.

In Paris, the rate difference is expected to be less drastic. Most hotels are still planning on pricing themselves in the 3-star rate category through July and August, with a trend of 36% of the 3-star hotels pricing up in the 4-star category. The 5-star hotel pricing is stable through July and August, with 10% of the 4-star hotels disclosing rates, pricing up from the end of July through the end of August.

Summer 2020 Outlook

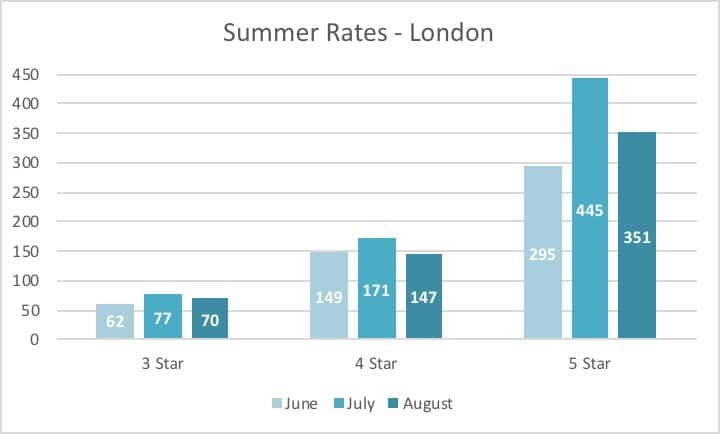

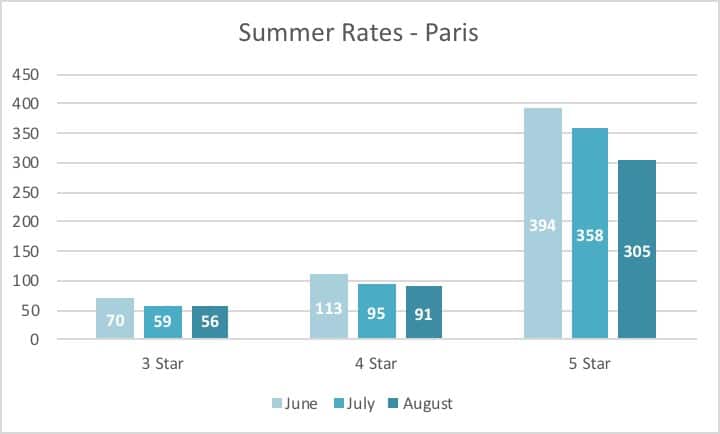

London rates are expected to peak in July while June and August’s performance vary between segments. Paris on the other hand, will peak in June across all three segments and expects a low season in August compared to the prior two months.

Evolution of Rates

In London, 5-star hotels have showed rates around $400. The more recent data indicated lower rates through June with a jump of about $180 in July. 4-star hotels have showed more consistency wavering between $150 – $190 through June and July. 3-star hotels have also shown consistent rates between $70 – $95, though recent data indicates slightly lower rates ($60 -$80) that have been adapted as more hotels begin to open.

In London, 5-star hotels have showed rates around $400. The more recent data indicated lower rates through June with a jump of about $180 in July. 4-star hotels have showed more consistency wavering between $150 – $190 through June and July. 3-star hotels have also shown consistent rates between $70 – $95, though recent data indicates slightly lower rates ($60 -$80) that have been adapted as more hotels begin to open.

In Paris, 5-star hotels are priced between $300 – $400, with declining rates as the summer progresses. 4 and 3-star hotels will experience the same pattern with rates around $80 – $120 and $40 – $75 respectively.

In general, both cities’ rates decrease as the arrival date approaches. This could be due to adjustments made as more realistic and present data becomes available. Anticipating rates further out will not be as accurate as the situation remains unclear.

Actions to optimise the revenue amidst Travel Restrictions

It will be important to pay attention to the evolving government regulations as this will affect your rate strategy and target market. Though hotels have re-opened, the EU border restrictions and mandated quarantine measures are still in place in many countries including the UK. Many events were also cancelled which further reduces the demand in both cities. This will have a large impact on international tourism and typical source markets, causing hotels to shift their focus to domestic tourism.

Below you can find easy actions to optimize your rooms’ revenue and increase your hotel value dependent on your strategic plan.

| Strategic Plan | Action |

| Room pricing based on competitors’ rates | Using RADAR you can adjust your rates to the segments you want to target and avoid overpricing |

| Room pricing based on additional services | Design relevant and tailor made packages |

| Room pricing based on customers’ segmentation | Respond with the most attractive products and marketing actions |

| Room pricing based on length of the stay | Adjust the product to domestic demand: hourly renting rooms to workers, training courses and pop-up events, focus on staycations |

| Room pricing based on historical data for the same rooms | Forecast the room rates by adjusting variable and fixed costs as historical demand may not be applicable |

| Room pricing based on supply and demand | Look for: travellers’ and airline traffic data, Google trends in your destination, track websites searches |

Methodology

The analysis is based on forecasted average room rates obtained from RADAR reports.

- Five reports with a 90-day outlook were considered from April 28th, May 4th, May 8th, May 20th and May 29th.

- Summer months include June, July, and August 2020.

- % of Hotels showing rates was used to determine the percentage of open hotels in a given market.

- Hotels are divided into three rate categories: 3-star, 4-star, and 5-star; 25 hotels were considered from each rating category.

- Each rating category is assigned a rate bucket and hotels can fluctuate between buckets depending on their current rates.

Written by

Vani van Nielen, Eliana Levine, Larina Maira Laube, Jedaiah Gwee, and Paloma Guerra from École Hôtelière de Lausanne, with the participation of Robert Hernandez.

Co-Published with Alex Sogno (CEO – Senior Hotel Asset Manager at Global Asset Solutions). Mr Sogno began his career in New York City after graduating with honours at Ecole Hôtelière de Lausanne, Switzerland. He joined HVS International New York, and he established a new venture at the Cushman & Wakefield headquarters in Manhattan. In 2005, Mr Sogno began working for Kingdom Hotel Investments (KHI), founded by HRH Prince Al-Walid bin Talal bin Abdul Aziz Al Saud member of the Saudi Royal family, and asset managed various hotels including Four Seasons, Fairmont, Raffles, Mövenpick, and Swissôtel. He also participated in the Initial Public Offering (IPO) of KHI at the London Stock Exchange as well as the Dubai International Financial Exchange. Mr Sogno is also the co-writer of the ‘Hotel Asset Management’ textbook second edition published by the Hospitality Asset Managers Association (HAMA), the American Hotel & Lodging Education Institute, and the University of Denver. He is the Founder of the Hospitality Asset Managers Association Asia Pacific (HAMA AP) and Middle East Africa (HAMA MEA).

Global Asset Solutions, your key partner in hotel asset management, has partnered with a team of students and alumnae from Ecole Hôtelière de Lausanne, recognized by industry leaders as the best hospitality school in the world. Together, we are working on compiling the best practices to help hotel owners and operators navigate through the COVID-19 crisis. By combining diligent research, expert opinions, and our own experiences, we will be publishing the best practices on the most current topics facing our industry. Our team is composed of Eliana Levine, Larina Maira Laube, Vani van Nielen, Marie-Amélie Pons and Paloma Guerra Lafuente with the guidance of EHL Lecturer Remy Rein.

Post

Portugal Hotel Market Outlook 2024

PORTUGAL’S HOSPITALITY INDUSTRY is experiencing an impressive comeback post…

Post

Know thyself for budget success

“Before you can budget for the year ahead, it is critical that you assess the…

Post

Should hotels refuse to join a club which would have them?

The current battleground for the big hotel chains is not pipelines, but loyalty…

Post

The digital concierge: how can hotels use technology to maximise revenue and customer experience?

More than half of all business trips are now a mix business and leisure – so…

Post

Spanish Hotel Market 2024

SPAIN’S TOURISM SECTOR in 2023 exceeded all initial expectations and surpassed…

Post

Balancing the scale of luxury

Tell someone in the sector your hot new tip is luxury growth and you’ll lose…

Post

The luxury sustainability conundrum

Climate change is one of the most significant challenges society is facing, but…

Post

Failing the AI tech race

Attend any conference over the past decade, and a common theme is the devilish…

Post

From compound stays to compound interest

Back in the days of yore - or, for those who measure time this way -…

Post

Projecting into an AI future

The world of hospitality has seen remarkable changes over the past few decades,…

Post

Bringing strength to soft brands

‘Another day, another brand’ could well be the catchphrase of our sector, but…

Post

The need for CAPEX and creating returns

As an asset manager, it’s my job to create and manage the relationship between…

Post

Budgeting for change pt.2

In the second of our series on the budget approval process, we are looking at…

Post

Budgeting for change pt.1

Each season brings with it change and, depending on the time of year, the…