As we enter Q3, there is no question that the COVID-19 pandemic has significantly impacted businesses worldwide. Hospitality has already been singled out as having notably suffered from travel restrictions and lockdowns, but one could argue that meetings and events have it the worst. The very definition, large groups of people gathering in a single location that is often indoors, makes it clear that the meetings and events industry has struggled a lot. Many events from Q1 and Q2 were postponed to Q3 and Q4; however, the previously anticipated start of recovery now seems to be increasingly unlikely as resurgences of cases occur worldwide.

Key trends in meetings and events industry after COVID-19 pandemic

For the meetings industry to recover as soon as possible, many already expect various steps to be taken, such as offering facemasks or installing contactless sanitizing stations. Yet it is more critical to acknowledge which trends present before COVID-19 will be advanced by current events, to establish long-term strategies for hotel meeting facilities and convention centers. It is only by taking a step back and establishing what was important to customers before the pandemic that hotels can correctly position themselves for both COVID-19 recovery and the many risks beyond. We will introduce three key trends that will be increasingly relevant as the industry bounces back and crucial for a long-term competitive advantage in meetings and events.

New patterns & Smaller meetings and events

First, asset managers and operators must understand what to expect once meetings and events start happening once more, to develop forecasts accurately. According to data from meetings market intelligence provider Knowland, it is likely that recovery will follow the pattern detected after previous recessions: smaller groups with smaller budgets who will book domestically. This pattern is all the more likely when combined with the travel restricted and hygiene driven needs associated with this recession. Therefore, facilities in secondary or tertiary markets could expect more bookings, but with smaller average meeting space booked. Convention centers should start considering how they could separate their large areas to create smaller zones. Hotels in these markets need to act quickly to attract these groups, while those in large cities like London or New York should think strategically and work with their local convention bureaus to rebuild their standing. Once your team understands these basic patterns, you can begin to consider how the following trends will impact your property

Related post: Forecasting in time of unknown

1. Safety and Security

Safety of both the host country and the venue has long been one of the top concerns for event bookers and attendees alike. A spike in acts of terrorism has made this all the more critical in the 21st century, pushing venues to put in place sturdy security and crisis communication plans. Next came the digital age, bringing with it a surge of privacy and data security worries, meaning venues to adapt and put in place new regulations and follow strict data procedures. Now, the concept of safety is stretched once again to include measures taken to avoid the spread of viruses and illnesses. Venues will need to be as agile and strict with new safety procedures as they were when reacting to the previous changes. Of course, part of modern-day safety requires increased cleaning, but only evidence of meeting certifications or standards could begin to entice event bookers and attendees to return. The two most important considerations are:

A. Evidence of Monitoring Attendees

Even before this pandemic, guests would feel unsafe if there was no one regulating who was entering the meeting or event. The same concept still applies, but now venue staff need to establish whether they are presenting any symptoms or if they are travelling from a high-risk country. In the shorter term, it might be necessary to take the body temperature at the entrance, but in the longer term, a survey sent before the meeting/event will likely suffice.

B. Emergency Scenario Planning

Similarly to the fire evacuation manuals found on every guest room door, sturdy plans for all scenarios regarding an illness outbreak at an event need to be well-communicated to both planners and attendees. If someone starts presenting symptoms at the event, all must be aware of who to notify, where to go and what measures to take. Small rooms must be available to quarantine suspected cases. Emergency planning also extends past the event, should attendees experience symptoms within two weeks. The venue must work with event planners to ensure attendees are strongly recommended, or even required, to notify organizers of symptoms or a positive test result. Actions must be established for all types and scales of events to determine whether or not other attendees should be notified, when, how and what recommendations to make.

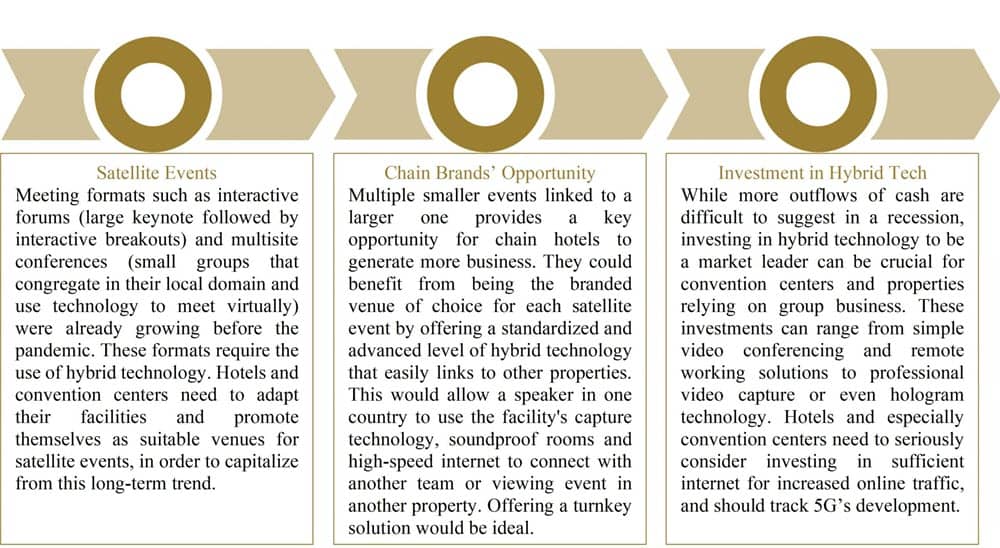

2. Hybrid Technology

Hybrid events (where both physical and virtual elements are present) were already on the rise before COVID-19 due to increased globalization, decreasing budgets, busy attendee lifestyles and technological advancements coupled with faster internet speeds. The quick transition of many Q2 events in light of the pandemic has proven how virtual events can be effective. While virtual events are not able to completely replicate all desired outcomes of events, such as high engagement, team bonding or networking, the amount of time and money saved was noticed. Most importantly, there was no chance of viral transmissions. Still, the aforementioned drawbacks highlight the necessity of hybrid instead of simply virtual events.

Hybrid events are the best way to deal with the many uncertainties of the pandemic: some will be able to travel across borders and be comfortable with interacting with others physically, and some not. While most virtual events have usually consisted of keynotes or panels being streamed to viewers, many more engaging and advanced formats are possible once events start being (partly) physical once more.

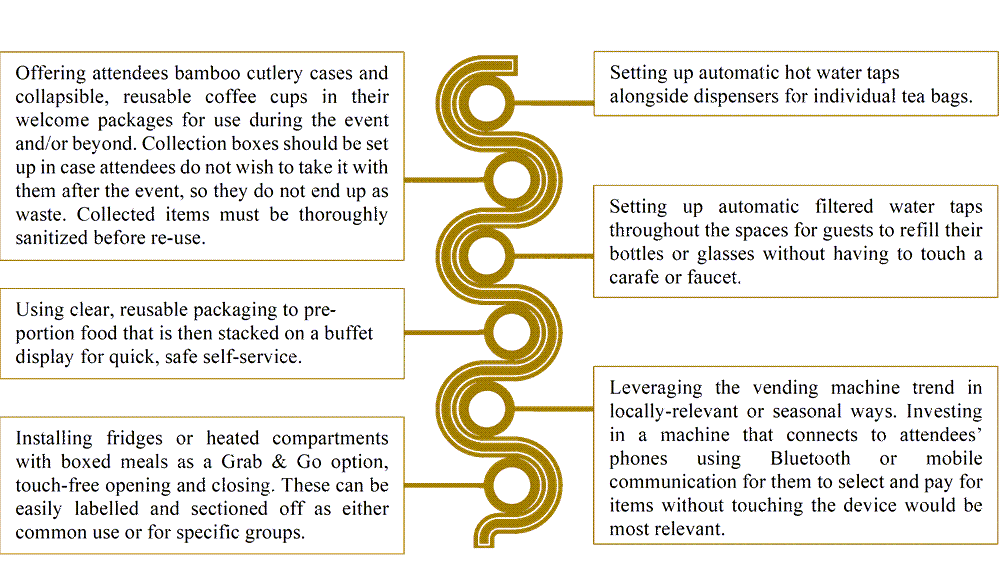

3. Rethinking F&B Service

The future of the meeting and events industry cannot be discussed without considering the F&B catering element. From buffets to busy coffee machines, F&B service at events raises many sanitation risks that most bookers and attendees will be unwilling to take during recovery. Still, from a risk-management perspective, it is crucial to find ways around this issue that the hotel or convention center can establish in their SOPs for the long-term to face any other black swan events better.

Currently, many ideas presented recommend only using individually wrapped cutlery or packaged foods. However, as sustainable initiatives at venues were a key trend demanded by both bookers and attendees before COVID-19, this is not a feasible long-term solution. Others suggest that buffets are now a thing of the past and that venues should pivot to plated meals. Unfortunately, plated meals do not allow for the quick and easy F&B service that makes buffets functional for meetings and events. Practical examples of durable practices that also meet short-term stringent sanitation requirements can be found in the illustration.

Related post: 100 ideas for the Food & Beverage industry post COVID-19

4. Consequences for Venue Sales and Marketing

Aside from the many impacts on the operational and structural elements of hotel meeting facilities and convention centers, COVID-19 will make a lasting impact throughout the purchasing funnel. To benefit as much as possible from the trends covered, venues must reflect on how to adapt their S&M processes.

A. Data-Driven Sales Strategies

This black swan event means that leveraging reliable external data is more useful than ever before. Sales solutions providers like Knowland allow venues to search their database to proactively target new group business and gain insight into group contacts with past booking patterns that match their property’s profile. This would allow venues to find local prospects they did not know before. Knowland’s COVID-19 Recovery Dashboard provides actionable insight on where the venue is positioned in comparison to its market and suggests strategies for accelerated growth. By using predictive industry data, hotels and convention centers can gain a competitive advantage by running sensitivities and identifying trends.

B. Virtual Site Visits

Before the pandemic, immersive, 3D or 360-degree experiences were already moving from the event itself to the booking and planning stage. Even though we expect more and more event planners to be selecting venues in their local markets, site visits are still time- and resource-intensive activities that require some element of travel and social interaction. These aspects are all the more undesirable in the expected weakened economy with a lasting aversion to unnecessary travel. Venues must adapt and begin incorporating 3D space diagrams, 360 tours or even Virtual Reality tools in order to save on time, staffing and costs, while also meeting a key need for event bookers: convenience. Platforms with these capabilities used by hospitality companies include Threshold 360, Matterport, Amadeus and Social Tables.

C. Flexibility with All-in-One Providers

Flexibility is a crucial need that, along with safety, will be all the more important during recovery. Uncertainty for the future means that few would be willing to guarantee attendee counts, room nights, space needs and more. Hotels and convention centers who are stubborn during the planning process and enact strict contractual obligations will lose out on the significantly reduced meeting and events business in the near future. Instead, it is important to incorporate the same flexible options offered by airlines or hotel guest rooms in the meeting and event facilities as well. Before COVID-19, more and more event planners were relying on all-in-one solutions, meaning vendors providing multiple services. By creating a partnership network with multiple vendors, such as additional IT, venues could create all-in-one packages that would limit the need for planners to enter numerous contracts and negotiate for flexible terms with all.

D. Giving Guidance in CRM

Many hotels and convention centers provide their customer contact with various tools through the booking and planning stage, such as capacity calculators or planning checklists. To improve CRM and help bookers feel safer, these tools should be expanded and refined to reflect the current situation. Suggesting additional steps for improving event safety and sanitation, recalibrating capacity calculators to allow planners to add larger distances between attendees, and offering consultations on how their event can be made hybrid using the venue’s available technology are all ideas to consider. Event planners are also stressed and challenged by impacts on the industry; venues need to understand their new needs and show they want to work together to create meaningful events and relationships lasting long after recovery.

Conclusion

While there are plenty of ideas and proposed solutions for the meetings and events industry, few are considering the future beyond the next year or two. Customers will not easily forget needs and trends that were well on their way to becoming permanent once their initial fears over the current pandemic are over. While other trends, like remote, outdoor venues for wellness-focused events, are better positioned to tackle the pandemic’s effects than city-center locations, most hotels and especially convention centers that rely on group business don’t have this option. Strategic-level reflection and reaction is the way for hotels and convention centers to position themselves for recovery on the long-term.

We encourage you to think critically about how to position your venue and use risk-management techniques to tackle both the current crisis and the long-term. Please contact us at info@globalassetsolutions.com; we would be delighted to help guide your team with paving the future of your meeting and event space.

Written by

Vani van Nielen, Eliana Levine, Larina Maira Laube, Jedaiah Gwee, and Paloma Guerra.

Co-Published with Alex Sogno (CEO – Senior Hotel Asset Manager at Global Asset Solutions). Mr Sogno began his career in New York City after graduating with honours at Ecole Hôtelière de Lausanne, Switzerland. He joined HVS International New York, and he established a new venture at the Cushman & Wakefield headquarters in Manhattan. In 2005, Mr Sogno began working for Kingdom Hotel Investments (KHI), founded by HRH Prince Al-Walid bin Talal bin Abdul Aziz Al Saud member of the Saudi Royal family, and asset managed various hotels including Four Seasons, Fairmont, Raffles, Mövenpick, and Swissôtel. He also participated in the Initial Public Offering (IPO) of KHI at the London Stock Exchange as well as the Dubai International Financial Exchange. Mr Sogno is also the co-writer of the ‘Hotel Asset Management’ textbook second edition published by the Hospitality Asset Managers Association (HAMA), the American Hotel & Lodging Education Institute, and the University of Denver. He is the Founder of the Hospitality Asset Managers Association Asia Pacific (HAMA AP) and Middle East Africa (HAMA MEA).

Global Asset Solutions, your key partner in hotel asset management, has partnered with a team of students and alumnae from Ecole Hôtelière de Lausanne, recognized by industry leaders as the best hospitality school in the world. Together, we are working on compiling the best practices to help hotel owners and operators navigate through the COVID-19 crisis. By combining diligent research, expert opinions, and our own experiences, we will be publishing the best practices on the most current topics facing our industry. Our team is composed of Eliana Levine, Larina Maira Laube, Vani van Nielen, Marie-Amélie Pons and Paloma Guerra Lafuente with the guidance of EHL Lecturer Remy Rein.

Post

Portugal Hotel Market Outlook 2024

PORTUGAL’S HOSPITALITY INDUSTRY is experiencing an impressive comeback post…

Post

Know thyself for budget success

“Before you can budget for the year ahead, it is critical that you assess the…

Post

Should hotels refuse to join a club which would have them?

The current battleground for the big hotel chains is not pipelines, but loyalty…

Post

The digital concierge: how can hotels use technology to maximise revenue and customer experience?

More than half of all business trips are now a mix business and leisure – so…

Post

Spanish Hotel Market 2024

SPAIN’S TOURISM SECTOR in 2023 exceeded all initial expectations and surpassed…

Post

Balancing the scale of luxury

Tell someone in the sector your hot new tip is luxury growth and you’ll lose…

Post

The luxury sustainability conundrum

Climate change is one of the most significant challenges society is facing, but…

Post

Failing the AI tech race

Attend any conference over the past decade, and a common theme is the devilish…

Post

From compound stays to compound interest

Back in the days of yore - or, for those who measure time this way -…

Post

Projecting into an AI future

The world of hospitality has seen remarkable changes over the past few decades,…

Post

Bringing strength to soft brands

‘Another day, another brand’ could well be the catchphrase of our sector, but…

Post

The need for CAPEX and creating returns

As an asset manager, it’s my job to create and manage the relationship between…

Post

Budgeting for change pt.2

In the second of our series on the budget approval process, we are looking at…

Post

Budgeting for change pt.1

Each season brings with it change and, depending on the time of year, the…