Italy as a destination is undoubtedly popular amongst international travellers, with the number of nights spent by foreign visitors consistently amongst the top three EU countries. In 2022, it ranked second only after Spain1. Post-pandemic, following the remarkable rebound in hotel investments in 2021 where the volume of transactions increased 92% YOY2, last year the country saw exceptional resilience in its hotel industry’s performance as shown below.

DOWNLOAD COMPLETE ITALIAN MARKET REPORT IN PDF HERE

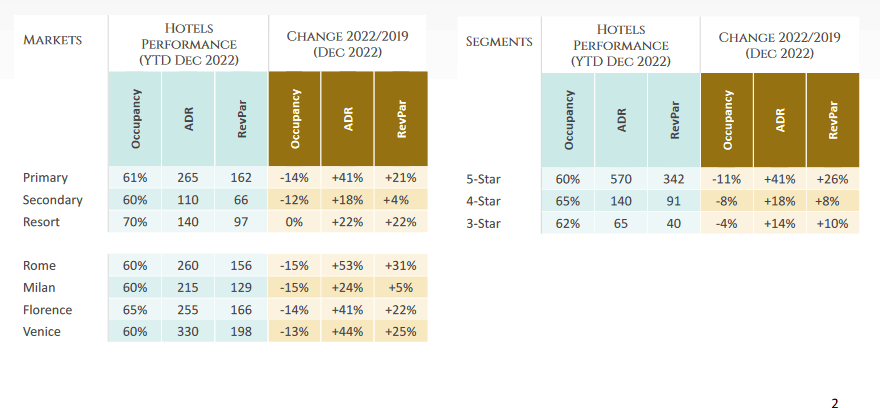

The market’s ADR and RevPAR in 2022 grew strongly above 2019 level. This was led by the major cities (+41% ADR, +21% RevPAR) and the resort market (+22% ADR, +22% RevPAR), contributed mainly by the 5-star luxury segment3. Thanks to these positive impacts, hotels in the country’s primary markets reported rising profitability levels despite wage inflation and higher energy costs.

Consequently, these incredible results continue to attract the attention of global brands and investors. At the GRI Club’s meeting earlier this year, hotels were recommended strongly as

an attractive option for investment and development in Italy, especially in the

luxury segment4.

Italian hotel performance 2022 By Market & Segment3

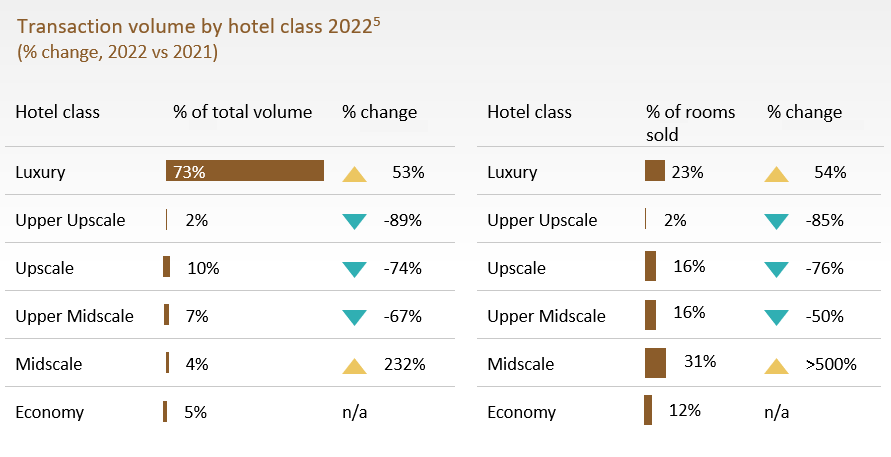

In 2022, the hotel investment volume in Italy reached €1.6 billion3. While this figure is lower than the previous year due to Europe’s complex economic and geopolitical situation, i.e. the Ukraine War, inflation, and energy cost, that leads to caution, there has been a growing interest in the hospitality sector in the last 10 years. In 2013, 10% of total Real Estate transactions in Italy were hotels, but the average share in the last four years has gone up to 15% with the total volume nearly doubled. Leading this growth is the high-value luxury hotel segment. Luxury properties make up an exceptionally high proportion, 73% of 2022’s total hotel transaction volume5, indicating significant interest in this segment.

Changing the face of the italian hotel market

In this country dominated by multi-generational family-owned businesses, recently there has been a growing investment appetite for branded hotels. In the Upper Upscale and Luxury space, the Chains’ penetration rate increased to 50.5% in 2021, meaning more than half of these hotels are branded with equal parts made up of international brands and domestic brands6. They typically target the high-paying foreign tourism segment, predominantly from the USA and UK and, thus, boast a much more premium room rate than the rest of the market.

Specifically, Italian 5-star hotel ADR and RevPAR in 2022 were at €570 and €342 respectively, which are each four times higher than the next tier 4-star hotels’ figures2. Hence, associating with high-quality brands for these types of properties is deemed beneficial.

Six Senses debut its first italian hotel in Rome, 2023

In terms of hotel inventory, in 2021, 5-star and luxury hotels accounted for only 1,8% of the total Italian hotel market stock, much lower than the average in Europe7. There is also a scarcity of prime assets in central locations and asset pricing has risen accordingly as the desire for international brands and investors to enter this market is building. However, this scarcity has driven the market for conversions and repositioning. This marks the predominant value-add strategy transactions in 2022, that will allow for an upgrade of the country’s hotel stock.

Another important trend to watch is the growth of the second-tier operated hotel segment (or properties managed by white-label operators), whose number of hotels increased by 18.7% in 2021 compared to the previous year6. The increasing presence of these third-party operators in the market will help create more options for hotel investors in terms of brand selection.

A recent hotel deal in May 2023 is another example of the above-mentioned movement. The 4-star 18th-century Grand Hotel Gardone on the shore of Lake Garda was bought from the Mizzaro-Papini family by Lithuanian hotel group Apex Alliance in partnership with Romanian investment firm Pavăl Holding. This hotel will be renovated and re-opened as a 5-star international branded hotel in 2026, managed by the white-label operator Apex Alliance Hotel Management8.

Looking forward to the future

Historically, the hotel market in Italy has been very fragmented and characterised by generational ownership, which makes it different and possibly challenging for outside investors to access. However, the pandemic has caused a shift in this.

A number of family-owned businesses are under post-Covid debt loads, which they may struggle to repay, especially if under pressure at the time of refinancing. As a result, more and more opportunities for foreign investors are expected to emerge over the next few years.

Italy has high barriers to entry, typified by close local relationships and challenging bureaucracy, so that off-market situations through direct dialogue with sellers are more likely. As such, overseas investors will benefit from working with experienced advisory support able to ensure access.

While the sentiment over foreign investors buying up Italian prized hotels is divisive amongst local industry insiders, the attractiveness of international luxury hotel brands that bring affluent tourists to the country is undeniable. This will also help upskill the local labour force and create more jobs as luxury hotels generally require a higher staff per guest ratio. It also has added benefits to the local economy as the associated businesses that will grow around these properties will positively impact the wealth and image of the entire destination.

Many leading luxury brands have appeared in Italy for the first time in recent years including Six Senses Rome debuting in March 2023. More excitement is in the pipeline as we will see the arrival of many first-timer international luxury brands in the coming years such as Edition, Orient Express, and Cheval Blanc9, which would have a positive effect on the market average room rate.

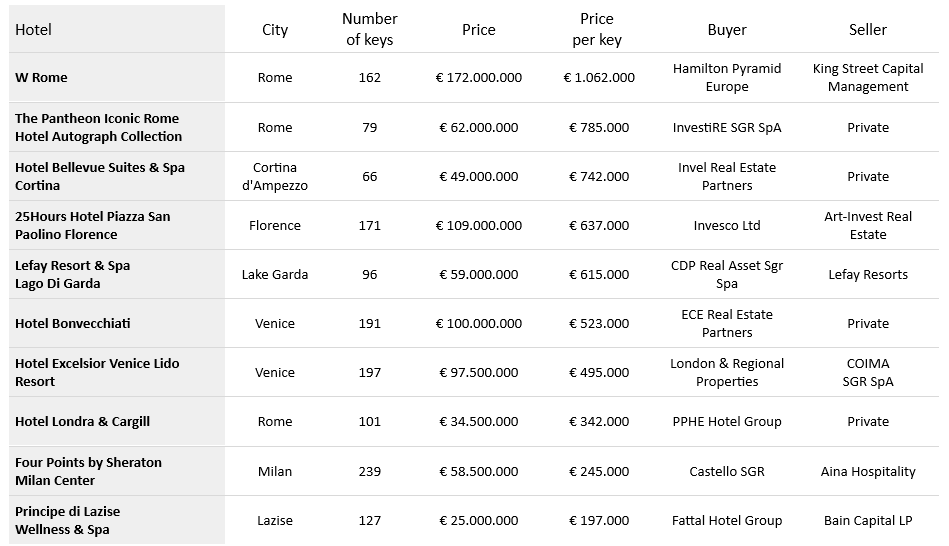

Selected major hotel transactions (2021-2023)

Currently, the markets of major interest remain the main Italian cities. Rome is leading in terms of future development, estimated at 2000 more rooms in the next 3 years, followed by Milan, and Venice10. While coastal cities and smaller towns, for example, in the Lake Region, are popular for tourists, the current lack of infrastructure and potential difficulty recruiting skilled labour make them less attractive. Nevertheless, during 2023, the overflow of interest in the Italian hotel market sees the arrival of capital towards secondary cities such as Verona, Bologna, Turin, Naples, and Catania, both for the dynamism of these places and for the highest achievable yields.

In support of sustainable growth for a future Italy, the Italian National Recovery and Resilience Plan was launched in 2021 with investment funding of €191,5 billion to tackle six major missions in coherence with the six pillars of the Next Generation EU11.

Some of the highlights directly impacting tourism and the hotel business include integrated funds to renovate and redevelop hotel facilities throughout Italy, a national villages plan for the tourist and cultural revitalisation of small towns, and a profound change in the transport offer to create more modern and sustainable roads, railways, ports and airports throughout the country within five years. As a result, these improvements will further expand hotel investment opportunities in the secondary market significantly in the coming years.

Much remains to be explored in this dynamic and evolving market. There seems to be an option for everybody. More than ever, hotel investors will benefit greatly from the combined expertise of a hotel-specialised investment advisor and dedicated asset manager, who has experience in Italian hotel transactions and provides end-to-end exclusive services.

The information and analysis presented in this report are gathered from various sources. No warranty or representation as to accuracy or completeness is made by Global Asset Solutions Europe SL, which shall have no obligation with respect to it.

All rights reserved ©2023 Global Asset Solutions.

1. Istat (2023). Outline Of The Strategic Tourism Development Plan For The Period 2023-2027.

2. EY Italy (2022). EY Italy Hotel investment report 2021.

3. Various sources as stated in CBRE (2023). 2023 Market Outlook Report – Italy Real Estate.

4. GriHub (2023). A Guide to the Hotel Outlook for Spain, Italy and Portugal in 2023.

5. MSCI Real Capital AnalyYcs (RCA) as stated in Cushman & Wakefield (2023). Market Beat Italy Hospitality Full Year 2022.

6. Horwath HTL (2022). Italy Hotels & Chains Report.

7. Istat (2021). AccommodaYon establishments: Capacity of collecYve accommodaYon establishments by type of accommodaYon.

8. Hospitality Net (2023). Europe Hotel TransacYons BulleYn – Week Ending 02 June 2023.

9. THRENDS (2023) Luxury Hotels Database as stated in ITHIC (2023). Italy, over

100 5-star hotels in pipeline for 2023-2027.

10. Top Hotel Projects (2022). Country Overview: Over 16,000 New Rooms to Enhance Italy’s Hotel Scene.

11. Italia Domani (2023). The NaYonal Recovery and Resilience Plan.

Post

Portugal Hotel Market Outlook 2024

PORTUGAL’S HOSPITALITY INDUSTRY is experiencing an impressive comeback post…

Post

Know thyself for budget success

“Before you can budget for the year ahead, it is critical that you assess the…

Post

Should hotels refuse to join a club which would have them?

The current battleground for the big hotel chains is not pipelines, but loyalty…

Post

The digital concierge: how can hotels use technology to maximise revenue and customer experience?

More than half of all business trips are now a mix business and leisure – so…

Post

Spanish Hotel Market 2024

SPAIN’S TOURISM SECTOR in 2023 exceeded all initial expectations and surpassed…

Post

Balancing the scale of luxury

Tell someone in the sector your hot new tip is luxury growth and you’ll lose…

Post

The luxury sustainability conundrum

Climate change is one of the most significant challenges society is facing, but…

Post

Failing the AI tech race

Attend any conference over the past decade, and a common theme is the devilish…

Post

From compound stays to compound interest

Back in the days of yore - or, for those who measure time this way -…

Post

Projecting into an AI future

The world of hospitality has seen remarkable changes over the past few decades,…

Post

Bringing strength to soft brands

‘Another day, another brand’ could well be the catchphrase of our sector, but…

Post

The need for CAPEX and creating returns

As an asset manager, it’s my job to create and manage the relationship between…

Post

Budgeting for change pt.2

In the second of our series on the budget approval process, we are looking at…

Post

Budgeting for change pt.1

Each season brings with it change and, depending on the time of year, the…